NewsNow

NewsNow

Today is the last day that Greyhound busses will operate in Western Canada, and parts of Ontario.

Greyhound announced earlier this year that it would end services in those areas as of October 31st; citing a large decline in ridership as one of the main reasons for doing so. Only one route, the Vancouver to Seatlle route, will remain in Western Canada.

Maple Bus Lines has stepped in to offer round-trip routes from Winnipeg to Thompson, which includes stops in Dauphin, Ste. Rose, Neepawa, and The Pas, among other stops.

The last Greyhound bus has already left Dauphin, and if you would like to view the schedules at Maple Bus Lines, click here.

- Details

- Contributed by Alec Woolston

The RCMP is offering some safety tips to make sure everyone stays safe when kids are trick-or-treating tonight.

For Motorists:

If you’re driving around tonight make sure you’re watching out for kids running around going house to house.

The police remind motorists that kids might forget simple pedestrian safety rules in all the excitement.

They also recommend going slower in residential areas and proceed with caution when going in or out of a driveway or backing up.

For the kids:

They recommend never trick-or-treat alone, so always walk with an adult or a group of friends.

Wear reflective, bright colour costumes so they can be seen.

And don’t go inside to get a treat, wait outside if the adult has to get something.

For homeowners:

Avoiding open flames in displays is one of the tips the RCMP are giving to homeowners as they celebrate Halloween.

Another tip they give is to keep your home and doorway well-lit and clear sidewalks and pathways for safety.

- Details

- Contributed by Josh Sigurdson

Canada Post announced earlier this morning that employees in Brandon and Winnipeg have returned to work.

Employees in Lloydminster, Saskatchewan, also returned to work today. However, strikes are ongoing in Saskatoon, Moose Jaw, and Weyburn. Workers also went on strike as of 12:01 this morning in Charlottetown and Summerside, P.E.I. There are 5 communities in British Columbia, and 7 in Ontario where strikes are ongoing as well.

Canada Post says they will work to restore service and deal with any backlogs as employees return to work.

- Details

- Contributed by Alec Woolston

Last night was a surprise for firefighter Ernest Karpiak, as he was given the Jack Carey Memorial Firefighter of the Year award.

The award is usually given out at the Firefighters Ball. However, Karpiak is going to be out of town that weekend, so the Dauphin Fire Department set up the surprise event.

Karpiak was going to city hall under the impression he was meeting the new councillors and explaining to them what the fire department does for Dauphin.

Karpiak explains how it feels to win the award.

“It feels very humbling to be nominated for this award and receive it. It is voted on by your peers for going above and beyond the call of duty and it truly feels amazing to be a recipient of it.”

He won the award because a few months ago he saved a co-worker from choking at a work function in Brandon.

- Details

- Contributed by Isaac Wihak

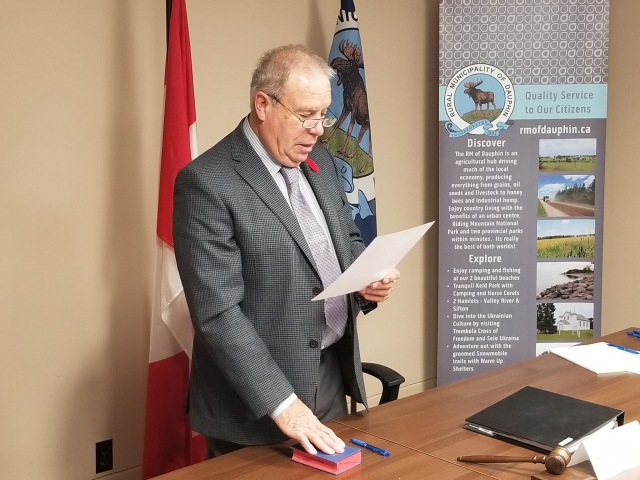

New councillors for the RM of Dauphin are sworn in.

The RM held a ceremony last night where each councillor took the oath of office.

New Reeve Ron Ryz is looking forward to working with the new group of councillors.

“I told the other councillors that they got elected as individuals and now we are going to work as a team. The RM we have our team in place already. We have our crew that works outside. Then we have our office team. The ladies in our office are awesome. They get along very well. Then we have our council, and we’re going to be a team. We’re going to put all those teams together and basically form one great super team."

He says they have a lot of work ahead of them and that he’s quite excited about it.

“We had a lot of accomplishments that we did last term, and we’re going to build on them. When we meet with council we will determine what direction they are going to go and what we are going to do.”

- Details

- Contributed by Josh Sigurdson

There were no injuries in the collision on Main St. yesterday afternoon.

A northbound car was turning left and was hit by a car driving south.

The two-vehicle accident occurred on Main Street by 7-11 and Parkland Source for Sports.

- Details

- Contributed by Isaac Wihak

A trailer was burned to the ground north of Ochre River.

The Ochre River Fire Department responded to the home around 1 in the afternoon yesterday and stayed until around 8 in the evening.

When they arrived, the entire building was fully engulfed in flames.

The fire department determent that a baseboard heater was probably the cause of the fire.

No one was home at the time of the fire.

- Details

- Contributed by Josh Sigurdson

The Farm Products Council of Canada has started the public hearing process to figure out the benefits of a hemp Promotion and Research Agency.

Having the hemp PRA would allow hemp growers to be involved in the advancement of the industry while helping them with research and promotion as well.

The biggest reason for getting a national agency is that hemp is a small acreage crop.

If there were 3 or 4 provincial agencies funds would get eaten up by administration costs.

- Details

- Contributed by Isaac Wihak

The final crop report from Manitoba Agriculture is out, and despite all of the challenges this year, most harvests are 98 to 100 per cent complete.

The only crop harvests outside of that range are the Sunflower harvest at 80 per cent complete, and the Grain Corn harvest at 61 per cent complete. The total amount of seeded acres across the province for Canola is 3,258,323, and for Soybeans is 1,892,391.

In the Northwest region of the province, Hard Red Spring Wheat yields have averaged around 65 to 85 bushels an acre, and Canola yields averaged around 50 to 60 bushels an acre.

See the full seasonal summary crop report here

- Details

- Contributed by Alec Woolston

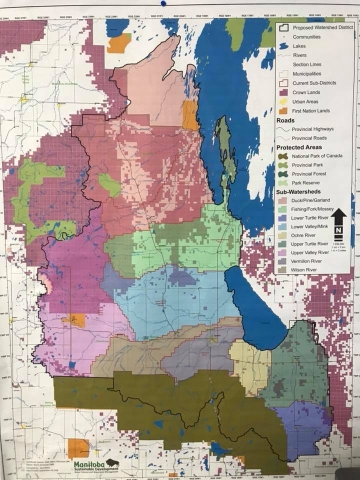

Intermountain Conservation and Turtle River Watershed Districts are being forced to come together.

Intermountain currently covers seven municipalities, and the merger area will cover around 15.

Jeff Thiele, the manager of Intermountain, says both are set up differently, and this is a concern as they come together.

“We’re going to have to get together and figure out how they are going to run one district that have two different mandates sort of thing, and how they are going to do all that. Because Turtle River is still going to have infrastructure to deal with. So how are they going to deal with that?”

Turtle River deal is an infrastructure district that deals with things like culverts and ditches while Intermountain focuses mostly on conservation projects.

“It doesn’t look like Intermountain is going to have to deal with the infrastructure, our way. So that will remain the same. Is Turtle River going to be able to do some of the conservation programming that we currently do in Intermountain?”

The province is forcing a merger in 2020, and they want a draft plan by this upcoming March.

Right now the province is saying the districts won’t get any extra money and stay at the current budget they are at right now.

Thiele says he knows it’s going to be a big job while planning for the future while also keeping their current projects going. But he thinks it can be done. It’ll just require a lot of work and communication.

(source: Turtle River Watershed Conservation District Facebook)

- Details

- Contributed by Josh Sigurdson

About 80 customers in Gilbert Plains lost natural gas service because of a leaking valve in the supply line.

The leak occurred early last night. The valve is now repaired and Manitoba Hydro service personnel have started the process of going door to door to assist affected customers with relighting any pilot lights on furnaces, hot water tanks, etc.

They will get to the remaining effected customers this morning.

- Details

- Contributed by Josh Sigurdson